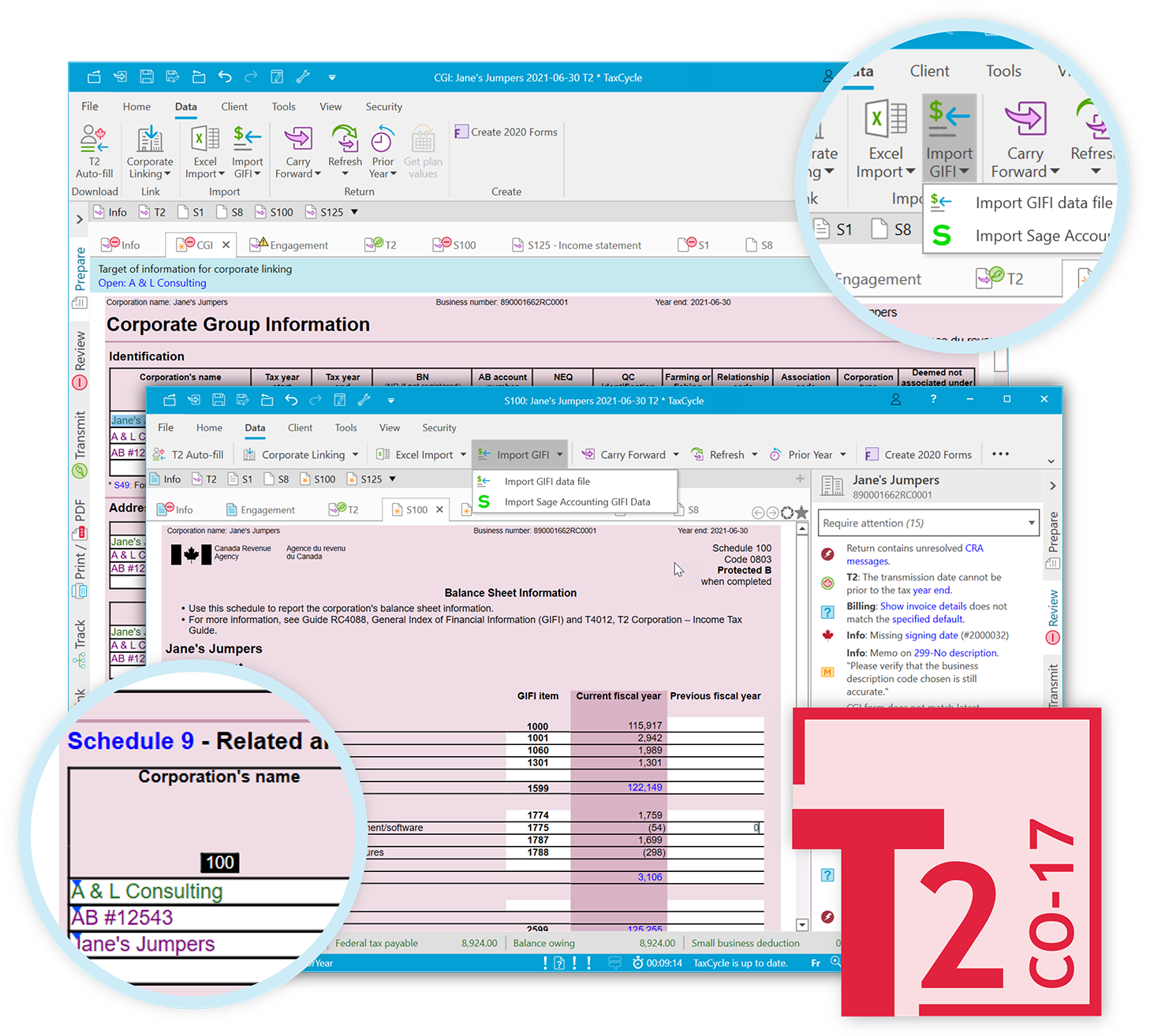

r&d tax credit calculation software

The results from our RD Tax Credit Calculator are only estimated. Many businesses are still unaware that RD credit eligibility extends beyond product development to include activities and even operations such as the latest manufacturing methods software.

Tips For Software Companies To Claim R D Tax Credits

Prepare Your RD Credit Get Cash Back.

. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. NeoTax Prepares a Study and Filing Instructions for Your CPA. Up to 12-16 cents of RD tax credit for every qualified dollar.

Prepare Your RD Credit Get Cash Back. Ad Companies in a variety of industries are now successfully utilizing RD credits. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

Ad Pilot Helps Your Business Maximize Savings. NeoTax Prepares a Study and Filing Instructions for Your CPA. See If Youre Eligible To Claim A RD Tax Credit.

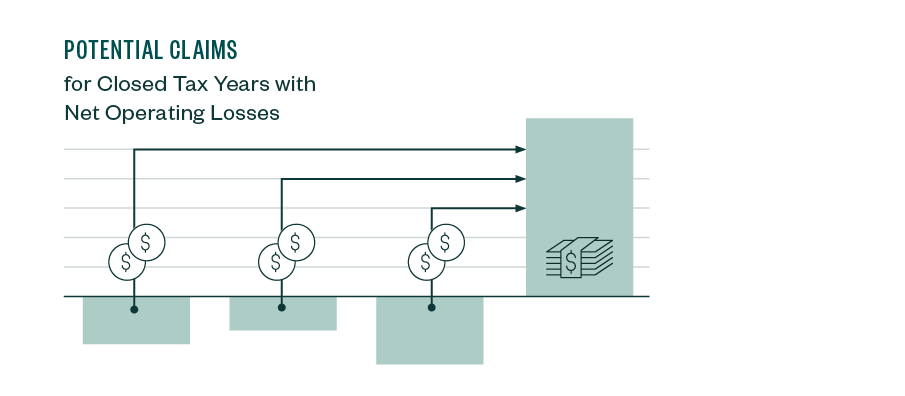

This allows companies to either recover taxes paid in the prior year or continue to carry. Follow up and gather more documents from anywhere. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim.

The RD tax credit can be carried back one 1 year and forward for a period of 20 years. Well Handle The Entire Process For You. Ad Early Stage Startups Can Claim the RD Tax Credit.

This is a dollar-for-dollar credit against taxes owed. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Simply put the RD tax credit creates money that goes back into your companys pocket to fuel further innovation and growth.

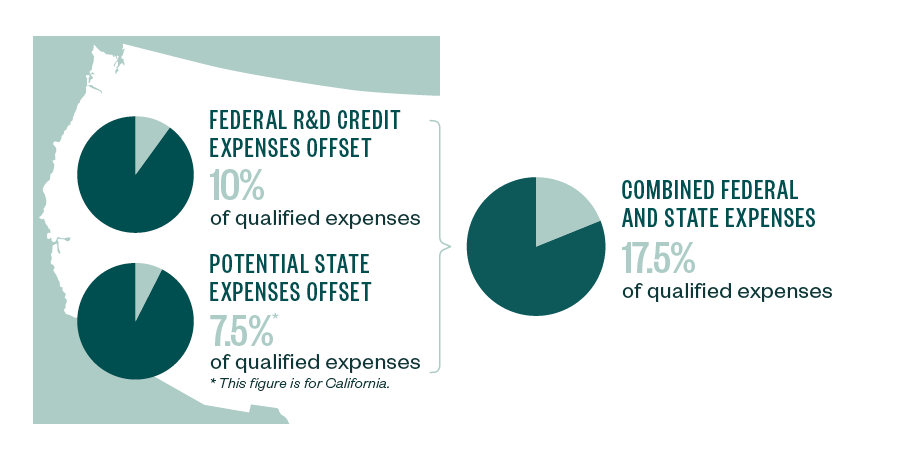

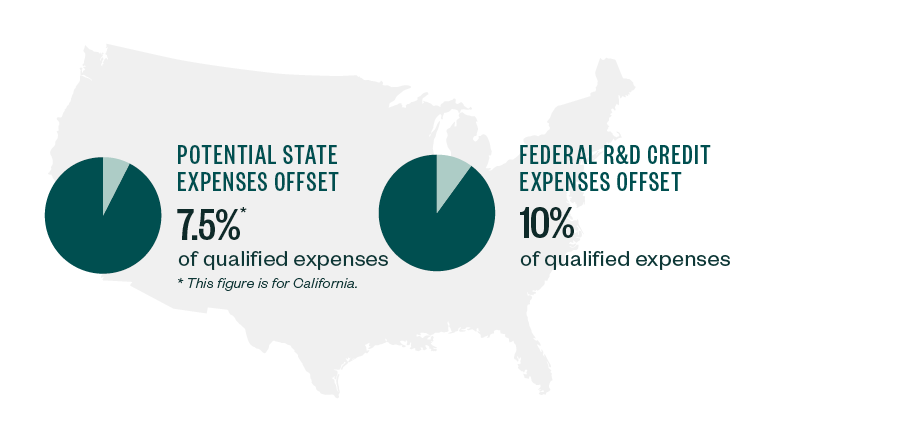

Our RD tax credit calculator. Many states even provide additional credit benefits against. Dollar-for-dollar reduction in your federal and state income tax liability.

Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim. A to Z Constructions average QREs for the past three years would be 48333. See If You Qualify.

Fifty percent of that average would be 24167. The ASC approach enacted in 2006 makes this calculation a bit easier with respect to the base amount rather than utilizing information from 1984-1988 a taxpayer can now elect on an. Section A is used to claim the regular credit and has eight lines of required.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765. Ad Determine If Youre Eligible To Claim The 2020 RD Tax Credit With Our Fast Easy Process.

These benefits can include the following. Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. Busineses In Technology Ecommerce Bio-Tech More Can Qualify.

This credit appears in the Internal Revenue Code section 41 and is. For software companies that meet the credit qualifications the federal benefit can exceed 10 of qualified expenses. Plus it carries forward 20 years.

First file the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2021 annual corporate form 1120 US Corporation Income Tax Return. If You Dont Qualify You Dont Pay. For most companies the credit is worth 7-10 of qualified research expenses.

Start filing for free online now. For startups applying the. Use our simple calculator to see if you.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Ad Over 85 million taxes filed with TaxAct. Ad Early Stage Startups Can Claim the RD Tax Credit.

RD TAX CREDIT CALCULATOR. Enquire now so Lumo can fully optimise. Lessen Your Tax Burden By Finding Out If Your Company Qualifies For RD Tax Credit.

RD Tax Credit Calculator. Tracks time and automatically sends surveys to clients. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques.

TaxAct helps you maximize your deductions with easy to use tax filing software. The RD tax credit research and development tax credit is a state and federal tax credit that rewards companies that create develop new products or processes or improve an existing. Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model.

If in 2022 A to Z Construction had. Estimate your RD credit with our quick calculator.

Best Accounting Sofware For Shopify Keep Track Of Your Finances

R D Tax Credit For Software Development Leyton Usa

Software Development Industry Tax Credits R D Tax Credit

Tips For Software Companies To Claim R D Tax Credits

![]()

Timesheet Software For R D Tax Credits Replicon

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

Turbotax Review Not The Cheapest Online Tax Software But Good For Complex Situations

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

![]()

Timesheet Software For R D Tax Credits Replicon

Tips For Software Companies To Claim R D Tax Credits

What Is R D Tax Credit How To Calculate And Claim It In 2022

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

Tips For Software Companies To Claim R D Tax Credits

![]()

Timesheet Software For R D Tax Credits Replicon

Tips For Software Companies To Claim R D Tax Credits

Does Software Development Count As A Research And Development Tax Credit